Société Générale, founded in 1864, is one of France’s largest and most well-known financial institutions, with a global presence spanning more than 60 countries. Known for its innovation, customer service, and commitment to sustainable development, Société Générale has grown from its French roots into a major player in international finance. With operations across retail, corporate, and investment banking, Société Générale offers numerous financial services designed to accommodate the requirements of individuals, businesses, and institutional clients.

This article offers a detailed examination of Société Générale’s history, services, corporate governance, and its outlook for the future.

Table of Contents

ToggleThe History of Société Générale

Foundation and Early Growth (1864-1900s)

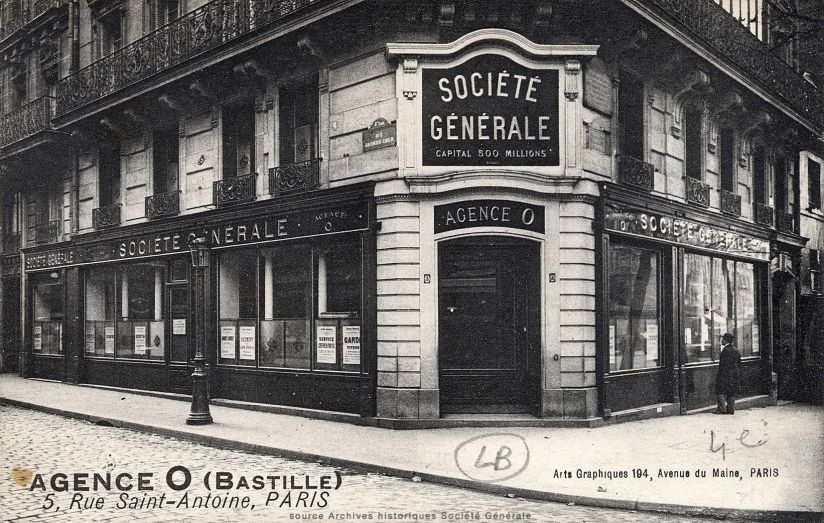

Société Générale was established on May 4, 1864, during a time of significant industrial development in France. Founded by a group of industrialists and financiers, its original mission was to promote the growth of commerce and industry in France by offering financial products tailored to business needs. The bank quickly gained prominence and began expanding its operations in France and abroad.

By the late 19th century, Société Générale had developed a robust branch network throughout France and established international offices in key financial hubs such as London and New York. The bank played a vital role in financing infrastructure projects, including developing railways and energy facilities, which were critical to France’s economic growth during that period.

The Post-War Era and Expansion (1950s-2000s)

Following World War II, Société Générale underwent a significant transformation. In 1945, the bank was nationalized as part of France’s broader post-war economic reforms to rebuild the country’s financial system. Despite its status as a state-owned institution, Société Générale continued to grow, expanding its portfolio of services and maintaining a strong international presence.

The bank was privatized in 1987, marking a new era of growth and diversification. Throughout the 1990s and 2000s, Société Générale expanded its operations in corporate and investment banking, asset management, and retail banking. It also became a leader in structured finance and derivatives, solidifying its position as a major player in the global financial markets.

Challenges and Resilience (2008-Present)

Like many financial institutions, Société Générale faced significant challenges during the 2008 global financial crisis. The bank navigated the crisis with cost-cutting measures, risk management improvements, and capital injections, allowing it to emerge relatively unscathed compared to some of its competitors.

More recently, Société Générale has focused on strengthening its balance sheet, optimizing its business lines, and investing in digital transformation to improve customer experience and operational efficiency. These efforts have positioned the bank for continued success in an increasingly competitive and regulated financial environment.

Société Générale’s Global Presence

Société Générale has built an extensive global network, with operations in over 60 countries across Europe, the Americas, Africa, and Asia. The bank’s international reach enables it to serve various clients, from retail to multinational corporations. The bank’s regional expertise allows it to tailor its products and services to accommodate the specific requirements of local markets.

In recent years, Société Générale has focused on expanding its presence in emerging markets, particularly in Africa and Asia. The bank views these regions as key growth drivers due to their expanding economies and growing demand for financial services. Société Générale’s international footprint also positions it well to serve businesses involved in cross-border trade and investment.

Services and Products

Société Générale offers a wide array of financial products and services across its three main business lines: Retail Banking, Corporate and Investment Banking, and Asset Management. Below is a detailed overview of the services offered by each division.

Retail Banking

Retail banking is at the core of Société Générale’s business, serving millions of individual customers worldwide. The bank’s retail offerings include several personal banking products and services, such as:

- Current and Savings Accounts: Société Générale offers various types of bank accounts, including current accounts for daily banking needs and savings accounts that provide competitive interest rates to help customers grow their wealth.

- Personal Loans and Mortgages: The bank provides personal loans, auto loans, and home mortgages with flexible repayment terms. These products are created to help customers achieve their financial goals, whether purchasing a home or financing a major expense.

- Credit and Debit Cards: Société Générale offers a range of credit and debit card products, each tailored to different customer segments. These cards come with features such as rewards programs, cashback, and exclusive offers from partner merchants.

- Online and Mobile Banking: Société Générale has invested heavily in digital banking solutions, providing customers with a secure and convenient way to manage their finances. The bank’s online and mobile platforms allow users to easily transfer funds, pay bills, apply for loans, and track their spending.

Corporate and Investment Banking (CIB)

Société Générale is renowned for its expertise in corporate and investment banking (CIB), which serves corporate clients, financial institutions, and governments. The bank provides a comprehensive suite of financial services, including:

- Financing Solutions: Société Générale offers a range of financing options to businesses, including syndicated loans, project finance, and asset-backed lending. The bank has a strong presence in key energy, infrastructure, and transportation sectors.

- Capital Markets: Société Générale is a leader in capital markets, providing clients with access to equity, debt, and derivative products. The bank’s global trading platform enables clients to execute trades in multiple asset classes, including equities, fixed income, commodities, and foreign exchange.

- Advisory Services: The bank offers advisory services to mergers and acquisitions, capital raising, and restructuring clients. Société Générale’s advisory team has extensive experience in helping clients navigate complex financial transactions, both domestically and internationally.

- Trade Finance and Cash Management: Société Générale provides trade finance solutions to help businesses manage their international trade operations, including letters of credit, guarantees, and documentary collections. The bank also offers cash management services, enabling businesses to optimize their liquidity and manage their payments more efficiently.

Asset and Wealth Management

Société Générale’s Asset and Wealth Management division caters to individual and institutional clients seeking to grow and manage their wealth. The bank offers various investment products, including mutual funds, bonds, equities, and alternative investments such as private equity and real estate.

- Wealth Management Services: For high-net-worth individuals, Société Générale provides personalized wealth management services, including portfolio management, estate planning, and tax optimization. Clients can access a team of dedicated advisors who tailor financial solutions to meet their unique needs.

- Institutional Asset Management: The bank also serves institutional investors, offering investment management services across various asset classes. Société Générale’s asset management arm is known for its expertise in responsible investing and sustainable finance, with a focus on integrating environmental, social, and governance (ESG) factors into its investment strategies.

Digital Transformation and Innovation

In today’s rapidly changing financial landscape, Société Générale has prioritized digital transformation as a key component of its growth strategy. The bank invests heavily in new technologies such as artificial intelligence (AI), blockchain, and big data to better customer experience and enhance operational efficiency.

Digital Banking Services

Société Générale’s digital banking platforms are designed to provide customers with easy access to their financial information and services. Through its Société Générale Mobile App and online banking platform, customers can manage their accounts, apply for loans, and conduct a variety of transactions in real-time.

Fintech Partnerships and Innovation Hubs

Recognizing the importance of innovation in the financial industry, Société Générale has established partnerships with several fintech companies to develop new products and services. The bank has also launched innovation hubs in major financial centers, where it collaborates with startups, technology firms, and academic institutions to drive the development of cutting-edge financial solutions.

Corporate Social Responsibility (CSR)

Société Générale is committed to corporate social responsibility (CSR), integrating social, environmental, and ethical considerations into its business practices. The bank’s CSR initiatives focus on four main areas:

Sustainable Finance

Société Générale is a leader in sustainable finance, offering a range of green and social bonds and financing solutions for projects that promote environmental sustainability.

Community Development

The bank is involved in several community development initiatives, including support for education, healthcare, and entrepreneurship programs. Société Générale also encourages its employees to engage in volunteer activities and provides financial support to nonprofit organizations that promote social inclusion and economic development.

Diversity and Inclusion

Société Générale promotes diversity and inclusion within its workforce, striving to create a work environment that is open, inclusive, and supportive of employees from diverse backgrounds. The bank has implemented policies aimed at promoting gender equality, supporting LGBTQ+ employees, and fostering a culture of respect and collaboration.

Future Outlook

As Société Générale looks to the future, it is focused on expanding its market presence, adapting to changing customer needs, and driving growth through digital innovation.

Digital Transformation

Société Générale will continue to invest in digital technologies, using AI, big data, and automation to streamline operations, improve efficiency, and offer personalized customer experiences. The bank aims to enhance its digital platforms to provide customers seamless access to financial services across multiple channels.

Sustainable Finance and ESG Integration

With environmental, social, and governance (ESG) factors becoming increasingly important, Société Générale plans to integrate sustainability further into its core business. The bank is committed to expanding its sustainable finance offerings and supporting projects that promote environmental conservation and social development.

Global Expansion

Société Générale plans to expand its operations in key international markets, particularly in Africa, Asia, and the Middle East. The bank sees significant growth potential in these regions and aims to capitalize on the increasing demand for financial services among individuals, businesses, and governments.

Conclusion

Société Générale’s long history, diverse product offerings, and commitment to innovation have cemented its status as one of the world’s leading financial institutions. As it navigates the challenges and opportunities of the modern financial landscape, Société Générale remains focused on delivering value to its customers, shareholders, and communities. Through its emphasis on digital transformation, sustainable finance, and global expansion, the bank is well-positioned to continue its legacy of success in the years to come.