Table of Contents

ToggleAre you on rent and worrying about your future in Egypt?

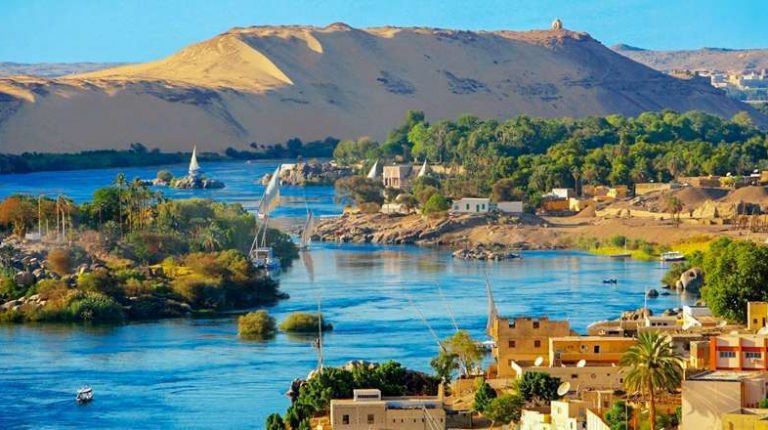

Egypt, with its timeless allure of ancient pyramids, desert landscapes, and the Nile River, has long been a global tourism magnet. From the bustling streets of Cairo to the serene beaches of Sharm El Sheikh, millions of tourists flock to Egypt annually to explore its historical treasures and natural beauty. However, beyond the cultural and economic significance of tourism lies a powerful, often underappreciated consequence: its influence on the real estate market—specifically, the short-term property value.

This article explores how fluctuations in Egypt’s tourism industry impact short-term property value, analyzing economic patterns, investor behavior, seasonal dynamics, and regional variations.

Tourism as an Economic Engine

Tourism is a vital sector in Egypt’s economy, contributing roughly 12% of the national GDP in peak years. It generates billions in revenue, creates millions of jobs, and draws substantial foreign currency into the country. A vibrant tourism industry brings with it increased demand for accommodation, services, transportation, and infrastructure development—all of which directly or indirectly affect real estate dynamics.

Short-term property value, which includes vacation rentals, serviced apartments, and second homes, is particularly sensitive to tourism patterns. When tourism booms, the demand for short-term rentals spikes, allowing property owners to charge higher rents and increasing the perceived value of these assets.

Rise of Short-Term Rentals and Platforms

The proliferation of platforms like Airbnb and Booking.com has transformed the rental landscape in Egypt. Cities like Cairo, Luxor, Hurghada, and Alexandria have witnessed a sharp increase in property owners converting residential units into short-term tourist accommodations.

In popular tourist zones, this shift has led to a surge in short-term rental prices, especially during peak seasons such as winter holidays, spring festivals, and religious events like Ramadan or Eid. Property owners can earn significantly more through short-term leasing than traditional long-term renting, leading to rising purchase prices for units in tourist-heavy districts.

For example, a two-bedroom flat in central Cairo or near the Pyramids of Giza can fetch 30–50% more in short-term rent during tourist high seasons, which in turn pushes up its resale value, especially if marketed as an investment property.

Seasonal and Event-Driven Price Fluctuations

Egypt’s tourism flows are distinctly seasonal. The months from October to April typically represent the high season, coinciding with cooler weather ideal for sightseeing. Conversely, the hot summer months see a dip in foreign tourist arrivals.

This cyclical pattern causes temporary shifts in short-term property value. During high season, the value of short-term rental properties increases due to greater rental income potential. This is especially true in locations like Luxor during the annual balloon festival or along the Red Sea during diving competitions or international kite surfing events.

Large-scale national or international events—such as the opening of the Grand Egyptian Museum or major archaeological discoveries—can also generate short-term spikes in demand, leading to localized property price increases as investors rush to capitalize on the influx.

Regional Variations: Cairo vs. Coastal Resorts

Tourism’s impact on property value varies widely by region. In Cairo, especially neighborhoods like Zamalek, Downtown, and Giza, proximity to cultural and historical sites increases short-term rental appeal. Here, tourists favor urban experiences, and investors target apartments and villas that can be converted into boutique rentals or guesthouses.

In contrast, Red Sea resorts like Hurghada and Sharm El Sheikh benefit from beach tourism. These regions attract not only foreign tourists but also expatriates and retirees, which affects both short-term and long-term property markets. During tourism booms, demand surges for seafront apartments and resort-style villas, boosting short-term property values significantly. Developers respond by launching new projects, which can temporarily saturate the market but also add modern inventory that attracts international buyers.

Foreign Investment and Currency Fluctuations

Egypt’s property market is often viewed as a haven for foreign investors during strong tourism cycles. International buyers—particularly from the Gulf, Europe, and Russia—purchase short-term rental properties as investment assets, betting on tourism-driven income. As foreign demand grows, so does competition for high-yield locations, driving up property prices.

Currency devaluation also plays a role. When the Egyptian pound weakens against the dollar or euro, Egypt becomes a more affordable destination for foreign tourists and investors. This tends to increase tourism while simultaneously making property more attractive (and cheaper) for foreign buyers. The combination of increased visitor numbers and heightened investment demand pushes up short-term property values, especially in USD or EUR terms.

Infrastructure and Government Policy

Government efforts to boost tourism—such as airport upgrades, transportation infrastructure, new archaeological museum developments, and relaxed visa policies—often correlate with rising short-term property values. New roads connecting Cairo to Red Sea resorts, or upgraded airports in Luxor and Aswan, enhance accessibility and therefore increase the rental potential of nearby properties.

Additionally, initiatives like the “Green Sharm” program or smart city development in New Alamein improve long-term attractiveness, creating fertile ground for short-term value appreciation tied to tourism growth.

On the policy front, Egypt’s relatively open stance toward foreign property ownership in designated zones encourages foreign buyers to participate in the short-term rental market, further reinforcing value appreciation.

Risks and Volatility

Despite the upsides, tourism-driven property markets are vulnerable to shocks. Political unrest, terrorist attacks, health crises like COVID-19, or geopolitical tensions can rapidly reduce tourist arrivals, slashing short-term rental income and property values.

For instance, the 2015 downing of a Russian passenger jet over Sinai caused a near-complete halt of Russian tourism—a major source of visitors to Egypt—which significantly depressed property values in Sharm El Sheikh and Hurghada.

Similarly, during the COVID-19 pandemic, international travel bans and safety concerns decimated Egypt’s tourism sector, leading to high vacancy rates in short-term rentals and forced price cuts in affected regions.

Conclusion: A Double-Edged Sword

In Egypt, tourism acts as both a growth driver and a barometer for short-term property value. In times of strong tourist flows, property owners and investors benefit from rising rents and capital appreciation, particularly in hot spots like Cairo, Luxor, and the Red Sea coast. Government investments in infrastructure and tourism development further support this trend.

However, the market remains susceptible to sudden downturns driven by external shocks. Investors must weigh the potential for high short-term returns against the inherent volatility of a tourism-dependent property sector.

For savvy buyers and developers, understanding the nuances of Egypt’s tourism dynamics can unlock profitable opportunities. But long-term success in this space demands resilience, risk management, and a deep awareness of both local and global trends.

Frequently Asked Questions

How does tourism contribute to short-term property value in Egypt?

Tourism increases the demand for temporary accommodation such as vacation rentals, serviced apartments, and guesthouses. Property owners can earn higher returns by leasing their properties short-term to tourists rather than through long-term contracts. This increased income potential raises the property’s market value, especially in areas popular with visitors like Cairo, Luxor, and Hurghada. When tourist numbers rise, so does the competition for high-yield properties, driving up short-term values.

What role do platforms like Airbnb play in Egypt’s short-term rental market?

Platforms like Airbnb have revolutionized Egypt’s rental market by making it easy for property owners to list and manage short-term rentals. In tourist hotspots, many owners now prefer short-term leasing over long-term tenants due to higher profitability. This shift leads to increased demand for property in key tourist areas, pushing up both rental prices and resale values. As a result, entire neighborhoods in Cairo and coastal cities have seen rising property prices directly linked to tourist demand through such platforms.

How do seasonal tourism patterns affect short-term property values?

Tourism in Egypt is highly seasonal, with peaks from October to April when the weather is milder. During these months, rental demand surges, leading to higher nightly rates and greater returns for property owners. In contrast, demand drops during the hot summer months, temporarily lowering rental income and property value potential. This seasonality creates predictable cycles in the short-term rental market, influencing how investors price and manage their assets.

What types of events can cause spikes in short-term property values?

Major cultural, historical, or sporting events can lead to temporary but sharp increases in short-term property values. For instance, the opening of the Grand Egyptian Museum or a high-profile archaeological discovery can draw thousands of international visitors, increasing demand for accommodation nearby. Similarly, events like international conferences, religious festivals, or sports competitions cause short-term surges in rental demand, allowing owners to increase rates and, by extension, the perceived value of their properties.