AXA Egypt, a subsidiary of the global insurance powerhouse AXA Group, has firmly established itself in the Egyptian market, providing several insurance and financial services to individuals, families, and businesses. Operating in Egypt since 2015, AXA is renowned for its commitment to innovative insurance products, quality service, and a strong focus on customer satisfaction. AXA Egypt’s offerings are designed to provide comprehensive protection and peace of mind, aligning with the group’s vision of “empowering people to live a better life.”

This article delves into AXA Egypt’s history, its wide array of services, its approach to digital transformation, corporate structure, and community-focused initiatives.

Table of Contents

ToggleAXA Group’s History and Expansion into Egypt

The AXA Group: A Legacy of Insurance Excellence

The AXA Group was founded in France in 1817. It started as a small mutual insurance company and gradually expanded its operations across Europe. Over the years, AXA solidified its position as a global leader, diversifying its insurance products to include life, health, property, casualty insurance, and investment and asset management services.

With a presence in over 50 countries and a workforce of over 160,000, AXA’s extensive experience and financial stability have made it a trusted choice for millions of customers worldwide. AXA’s entry into the Egyptian market marked a significant milestone, enabling the group to extend its reach further within North Africa and the Middle East.

AXA Egypt’s Establishment and Growth

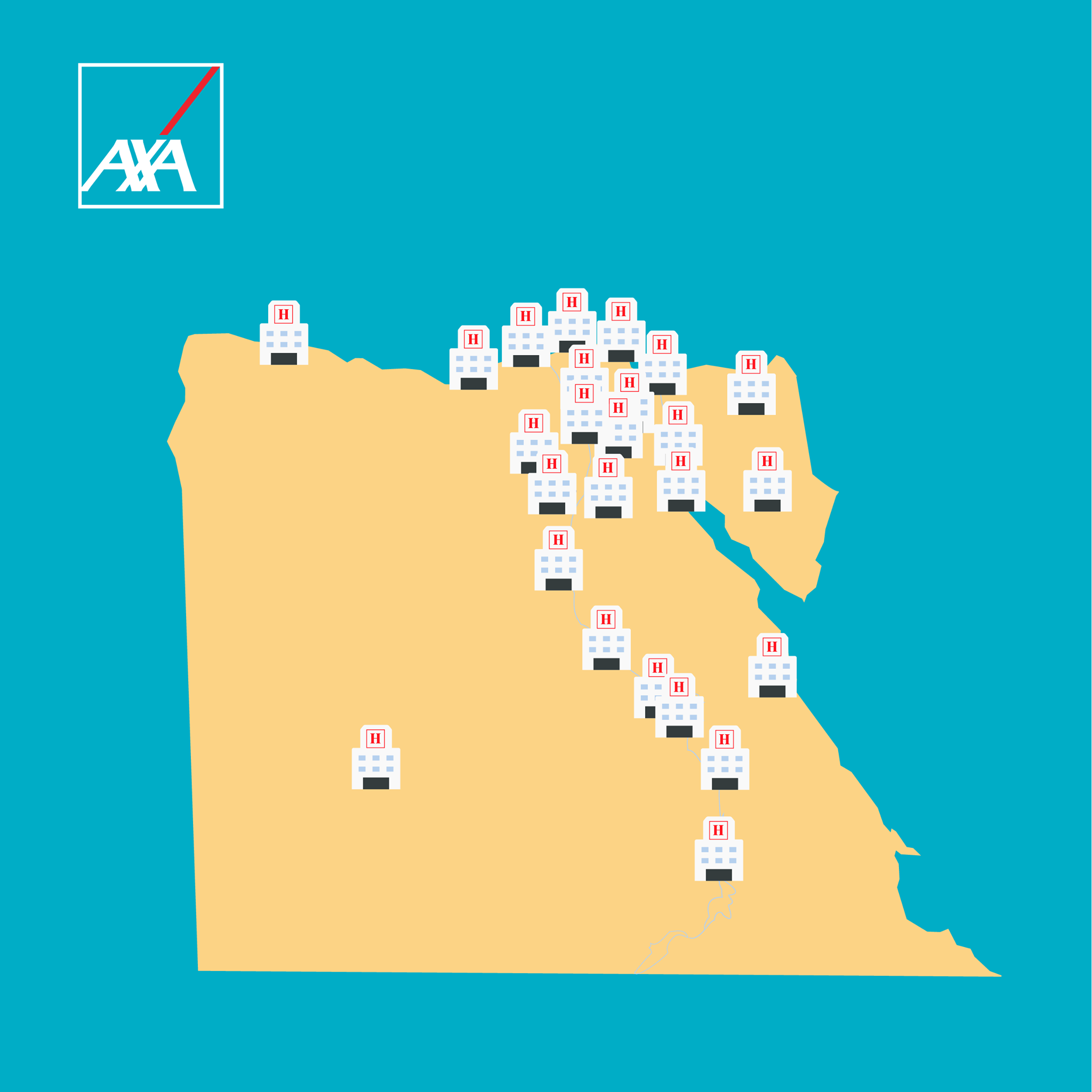

AXA entered Egypt in 2015, partnering with Commercial International Bank (CIB) to distribute insurance products through one of Egypt’s most prominent banking networks. This collaboration allowed AXA Egypt to rapidly reach a broad customer base, establishing itself as a prominent player in the Egyptian insurance market. AXA’s approach in Egypt combines local expertise with the global standards and resources of the AXA Group, creating tailored solutions for Egyptian clients.

Key Services and Products Offered by AXA Egypt

AXA Egypt offers diverse insurance products, focusing on providing holistic protection and support to individuals, families, and businesses. Below is an overview of its primary services:

Health Insurance

AXA Egypt’s health insurance policies are designed to provide comprehensive medical coverage, catering to various needs, from routine doctor visits to complex surgeries. AXA’s health insurance options include:

- Individual Health Insurance: This plan covers medical consultations, specialist visits, hospital stays, and surgical procedures. Customers can select from different levels of coverage to suit their health needs and budget.

- Family Health Insurance: AXA’s family health plans extend coverage to spouses and children, guaranteeing the entire family is protected. The plan includes access to a network of top-tier hospitals and clinics, making quality healthcare accessible for policyholders and their families.

- Critical Illness Coverage: AXA provides specific coverage for serious illnesses such as cancer, heart disease, and other life-threatening conditions. This plan provides additional financial support during treatment, helping families manage medical expenses during challenging times.

Life Insurance

AXA Egypt offers various life insurance products to help individuals secure the financial future of their loved ones. These options include:

- Term Life Insurance: This policy provides coverage for a specific term, offering financial protection in case of the policyholder’s untimely death. Term life insurance is an affordable solution for individuals looking to protect their families financially for a set period.

- Whole Life Insurance: With this plan, policyholders enjoy lifelong coverage, making it a valuable option for those who wish to ensure their family’s financial stability for generations.

- Savings and Investment Plans: AXA Egypt combines life insurance with long-term investment plans, allowing policyholders to accumulate savings for future goals, such as children’s education or retirement.

Property and Casualty Insurance

AXA Egypt’s property and casualty insurance plans cater to individuals and businesses, protecting assets against unforeseen events. Key products include:

- Home Insurance: This plan covers property damage caused by fire, natural disasters, theft, or vandalism, ensuring policyholders can repair or replace damaged belongings.

- Motor Insurance: AXA offers comprehensive car insurance policies covering vehicle damage, theft, and liability for third-party injuries or property damage. Clients can choose from several coverage levels based on their needs and preferences.

- Business Insurance: AXA Egypt’s business insurance policies protect companies against risks, including property damage, liability, and employee-related incidents. Customized plans suit different business types and sizes, providing peace of mind for business owners.

Travel Insurance

AXA Egypt’s travel insurance products provide comprehensive protection for travelers, covering medical emergencies, trip cancellations, lost luggage, and more. Travelers can select from different levels of coverage to suit the nature and length of their journey.

AXA Egypt also includes COVID-19 coverage, giving travelers added security in case of health issues related to the pandemic. The travel insurance options include:

- Medical Coverage Abroad: Coverage for medical treatment in case of illness or injury while traveling internationally.

- Trip Cancellation and Delay Protection: Financial reimbursement for canceled or delayed trips due to unforeseen circumstances.

- Luggage Protection: Coverage for lost, damaged, or stolen luggage, helping travelers replace their belongings without added stress.

Corporate Structure and Governance of AXA Egypt

AXA Egypt operates as a subsidiary of the AXA Group, functioning under a management team with deep knowledge of the Egyptian market and the global insurance industry. The corporate structure allows AXA Egypt to provide services specifically tailored to Egyptian consumers, aligning with local cultural and economic needs.

The governance framework at AXA Egypt reflects AXA Group’s commitment to transparency, ethics, and accountability. A board of directors oversees strategic decisions, risk management, and regulatory compliance, ensuring AXA Egypt meets the group’s high standards and local requirements.

Digital Transformation at AXA Egypt

Recognizing the need for digital solutions in a rapidly changing world, AXA Egypt has invested significantly in technology to streamline its services and enhance the customer experience. Key aspects of its digital transformation include:

Online Platforms and Mobile Applications

AXA Egypt’s digital platforms enable customers to easily manage their policies, make claims, and access support services. The AXA app provides a user-friendly interface for policy management, payment processing, and accessing customer support.

Telemedicine and Virtual Healthcare

In response to the growing demand for virtual healthcare services, AXA Egypt introduced telemedicine options for policyholders, allowing them to consult with medical professionals remotely. This service reduces wait times and offers clients a convenient, accessible alternative to traditional doctor visits.

AI-Powered Customer Support

AXA Egypt employs artificial intelligence (AI) and machine learning in its customer support systems, utilizing chatbots and virtual assistants to provide real-time assistance and answer common queries. This automation enhances efficiency and allows customers to receive immediate responses to their inquiries.

Commitment to Corporate Social Responsibility (CSR)

AXA Egypt is deeply committed to social responsibility, supporting initiatives that promote financial inclusion, environmental sustainability, and community development.

Environmental Responsibility

AXA Egypt has launched initiatives to reduce its environmental footprint, aligning with AXA Group’s global sustainability goals. The company promotes recycling, energy efficiency, and reduced paper use within its offices. Furthermore, AXA Egypt contributes to climate-related initiatives and supports efforts to combat environmental issues in Egypt.

Financial Inclusion Initiatives

AXA Egypt is dedicated to increasing underserved communities’ access to insurance and financial products. The company collaborates with local organizations and policymakers to develop affordable insurance products that provide essential coverage for low-income populations, ensuring more people can access essential financial protection.

Community Development Programs

AXA Egypt addresses education, health, and economic development issues through various community engagement programs. The group’s charitable arm, AXA Foundation, funds scholarships, educational programs, and healthcare initiatives, positively impacting Egyptian society.

Future Prospects and Strategic Goals for AXA Egypt

AXA Egypt is focused on expanding its services and strengthening its market presence. Key strategic priorities include:

Expanding Digital Services

With digitalization shaping the future of insurance, AXA Egypt aims to continue investing in technology that enhances customer experience and operational efficiency. Upcoming advancements include additional AI-powered tools, new digital payment options, and personalized product recommendations.

Innovative Insurance Products

AXA Egypt plans to develop innovative products tailored to changing consumer needs, such as insurance solutions for freelancers, gig workers, and remote employees. This expansion will allow AXA Egypt to serve a wider customer base and stay relevant in a dynamic labor market.

Strengthening Financial Education Initiatives

AXA Egypt recognizes the importance of financial literacy and plans to increase its financial education efforts, focusing on helping individuals make informed financial decisions. These initiatives aim to empower consumers with the knowledge needed to manage their financial future.

Conclusion

AXA Egypt’s extensive range of insurance products, combined with a strong digital presence and a commitment to social responsibility, has established it as a trusted partner for individuals, families, and businesses in Egypt. The company’s continuous investment in technology, customer-centric approach, and dedication to supporting community development reflect AXA Group’s global vision of empowering people to live better lives.

As AXA Egypt moves forward, it remains dedicated to innovating its offerings and expanding its market reach, ensuring that it meets the evolving needs of its clients. Through its focus on financial inclusion, environmental responsibility, and a seamless digital experience, AXA Egypt is well-prepared to continue leading in the Egyptian insurance market.